For the past few weeks Orange County Treasurer/Tax Collector Chriss Street has alerted me to the financial games played by Timothy Geithner, our current Secretary of the Treasury. Based on breaking news from New York we agreed to release this Guest View today.

We all recall horror stories of former OC Treasurer Bob Citron’s gambling with taxpayer funds in the derivative market that drove Orange County into bankruptcy.

In this case the New Your Fed has agreed to release documents requested by (R) Congressman Darrell Issa that involves AIG.

My sense is that president Obama will shortly begin a search for Timothy Geithner’s replacement.

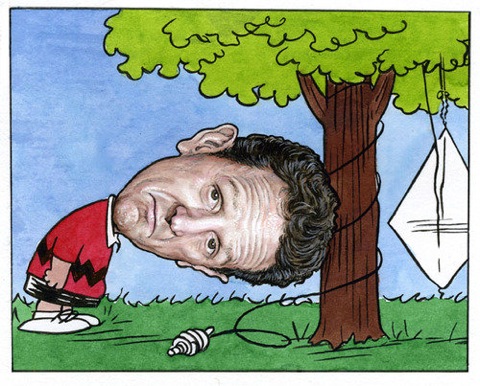

Geithner’s Grand Deception, by Chriss W. Street

“Treasury Secretary Timothy Geithner has again found himself in the hot seat. Congress now has email evidence proving what many Americans have suspected from the outset; Goldman Sachs and other powerful elites received special treatment by the Geithner led New York Federal Reserve during the taxpayers’ rescue of AIG. Up until now, Mr. Geithner has ducked lawmakers’ inquiries, by hiding behind the complexity of Wall Street’s exotic financial strategies. As the smoke clears, lawmakers are quickly realizing that the bailout is yet another example of preferential treatment given to the privileged few. These timely and inconvenient revelations about Mr. Geithner may very well disrupt his quest to seize greater control over our nation’s financial markets.

The “Over-the-Counter-Derivatives Markets Act of 2009,” which passed the house Financial Services Committee on a party line vote late last year, is cleverly designed with a “trigger” to facilitate a White House takeover of the $54 trillion credit derivatives markets. The draft legislation warns that if:

“SEC and the Commodities Futures Trading Commission cannot jointly proscribe uniform rules and regulations under any provision of the this Act in a timely manner [60 days], the Secretary of the Treasury…shall prescribe rules and regulations under such provision.”

Considering the decades of toxic territorial feuding between the SEC and CFTC, Geithner and the Obama Administration will quickly usurp oversight of this behemoth market.

Mr. Geithner’s dubious regulatory record as President of the Federal Reserve Bank of New York from 2003 to 2008, makes him a curious candidate to become “Master of the Derivative’s Universe.” When spectacular problems in the credit Default Swaps (CDS) markets came to his attention following the bankruptcies of Delta and Northwest Airlines in 2005, he knowingly let his pals maintain their solvency facade.

Every day billions of dollars of CDS contracts traded between banks, brokers and hedge funds, but signed settlements were delayed for up to 18 months. Literally hundreds of billions of dollars of outstanding derivative contract risk floated off the balance sheets of major financial institutions. This strategy allowed credit derivatives market traders to engage in the equivalent of “check-kiting” on a grand scale.

The 2005 market turmoil and the breadth of the derivative losses made clear to the New York Fed that many banks were engaged in activities that skirted prudent banking standards. As head of trading for the world’s largest bank, Mr. Geithner could have used his authority to force the derivative industry to comply with settling all trades in three days. Instead of acting decisively to eliminate a known and growing systemic threat, he watched financial cancer quickly metastasize.

In an October 4, 2005 letter to Mr. Geithner, the “Major Dealers” modestly committed to reducing the number of unsettled trades outstanding beyond 30 days, by 30% over the next five months. The letter, signed by Bank of America, Barclays, Capital, Bear Stearns, Citigroup, Credit Suisse, Deutsche Bank, Goldman Sachs, HSBC, JP Morgan Chase, Lehman Brothers, Merrill Lynch, Morgan Stanley, UBS and Wachovia states unequivocally that anything less than “significant progress on our backlog…will be unacceptable.”

Over the next 2 1/2 years, the Major Dealers spoke regularly with the New York Fed regarding the “tactical” steps they were taking to reduce the enormous number of outstanding trades. In a March 27, 2006 letter to Geithner, the Major Dealers agreed to provide only “informal updates” on their efforts to implement industry wide processing guidelines by the end of the year.

At a time when dangerous activities in the Credit Derivatives market demanded legal scrutiny and public disclosure, Geithner permitted the industry to avoid unpleasant intrusions into the most profitable business practices. Given, confirmations should have been sent in 1 day and signed contracts and collateral transferred in a maximum of 3 days, it is clear the New York Fed was willing to allow the industry to self-police their way back into compliance.

It took one of the Major Dealers imploding to spur industry change. Two weeks after the collapse of Bear Stearns, in a letter dated March 27, 2008, the Major Dealers agreed “to educate the marketplace” regarding the benefits of clearing trades legitimately. By then, Geithner and a rogue’s gallery of clever Goldman Sachs alums were pouring billions of taxpayer dollars into a market already in the clutches of a death-spiral.

The mantra of the Obama Administration has been “you never want a serious crisis to go to waste.” Before handing the keys of the regulatory kingdom back to the deceptive Mr. Geithner, the public should demand to know exactly what he knew about the billowing risk in the derivative markets and why he failed for three years to act in the best interest of the Nation.”

This isn’t just Geithner. This is really any Wall Street honcho and any governmental financial type…many of whom move back and forth from the private sector, into government, and then back again. They all knew about OTC derivatives and other highly unregulated instruments and the risks involved. Look up the term “oligarchy” to get a glimpse into the direction this country is going. They all got warned back in the late 90s by one Brooksley Born…and she got silenced by the Greenspans, Geithners, Rubins of the world.

http://www.pbs.org/wgbh/pages/frontline/warning/?utm_campaign=homepage&utm_medium=proglist&utm_source=proglist

One more thing…I think Americans in general also need to look inward on this subject and begin to question the long-term impact of cultural values like “I want it now” or It’s all about me”, etc. We were certainly willing participants in attitudes and actions that contributed to the financial crisis.

The blaming of Citron for the county’s failed investment casino without also blaming the esteemed 5 person Board of Supervisors is a big mistake. Those 5 people knew darn well that he was producing returns that were literally unbelievable, and rather than question this result they encouraged him to keep it up and treated Citron like a Rock Star. It is those 5 who deserve the largest share of blame and any time Citron is named as the culprit they should also be included. By the way, has anyone noticed that all 6 of these bankruptcy creators were elected, not “faceless civil service bureaucrats”?

BAW. You are correct. The same applies to this post where our president should have been aware of Geithner’s activities if he did a thorough job of vetting him out before placing him into that powerful post.

Larry:

Nice write up and very nice picture.

Maybe Geithner can get his “Perp Walk” ready for all of to see. he should be joined by Dodd, Frank, Acorn, and the other crooks.